Va streamline refinance calculator

VA Streamline Refi 2022 March 25 2022 FHA Streamline Refinance. How much does the VA Funding Fee Cost.

Va Mortgage Calculator Calculate Va Loan Payments

A VA cash-out refinance is the only option for those who dont already have a VA loan.

. This is a great loan offering but what about borrowers who dont need to do extensive rehab work to. The funding fee increases to 360 for those borrowing a second VA loan. Call 1-888-842-6328 for more information.

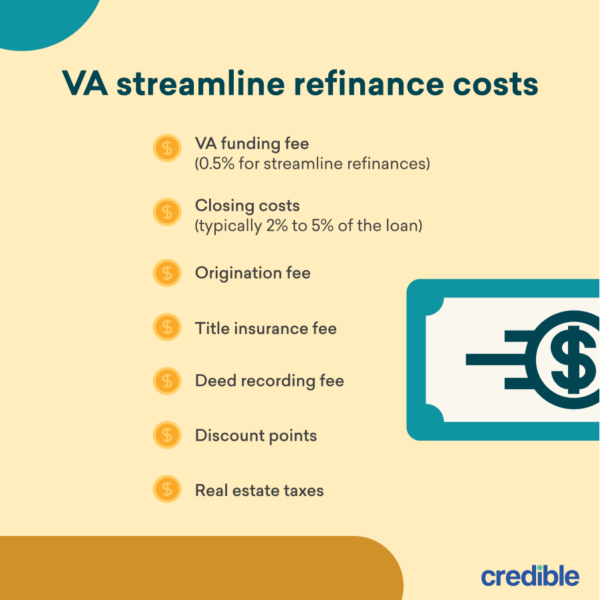

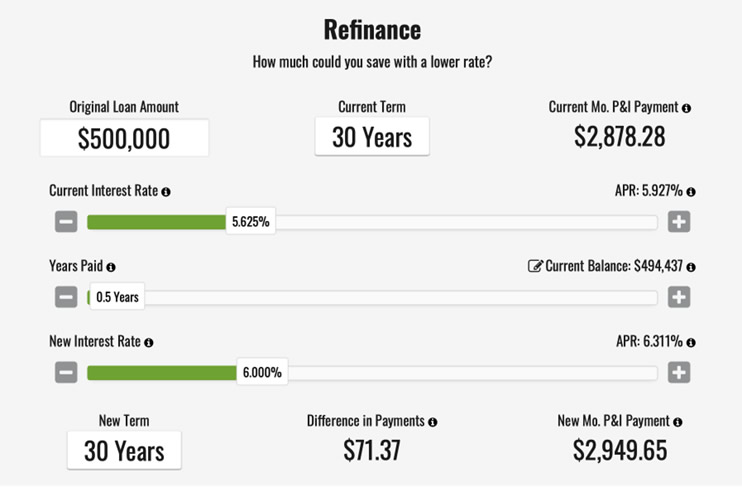

A refinance calculator can help you estimate your savings. Select the Funding Fee Select fee 000 050 100 125 140 165 230 360. VA cash-out refinance requirements can vary by lender the loan amount and more.

You must meet VA service requirements for VA loan eligibility. The VA cash-out refi has a couple of advantages over the VA IRRRL also known as the VA streamline refinance. VA Home Loan Calculator.

Calculate the breakeven point Use a mortgage refinance calculator to determine the breakeven point which is the number of months it takes for the savings to outweigh the cost of refinancing. The funding fee rate is only applied to the amount financed in the VA loan so no fee is applied to a borrowers down. Disability and Prior VA Loan Use.

Our VA loan calculator easily computes and compares accurate VA loan mortgage payments including applicable VA funding fee taxes insurance. Youd be hard pressed to find a whole lot of drawbacks to a VA home loan. As of January 1 2020 the VA funding fee rate is 230 for first-time VA loan borrowers with no down payment.

VA Streamline Refinance IRRRL Qualified VA borrowers have access to one of the most straightforward and powerful refinance options around. VA Streamline IRRRL. Receive up to 100 percent of your equity as cash back at closing but note some lenders will only.

VA Streamline refinances also known as IRRRLs Interest Rate Reduction Refinance Loans carry a reduced funding fee of 05. Homebuyers whove used a VA loan before and arent exempt from the VA funding fee typically pay a higher VA funding fee - generally 36 percent of the loan amount. 2550 Paseo Verde Parkway Suite 100 Henderson NV 89074 United States.

The VA IRRRL also known as a VA streamline refinance. 5625 6320 APR with 1250 discount points on a 60-day lock period for a 15-Year VA Cash-Out refinance and 6125 6468 APR with 0375 discount points on a 60-day lock period for a 30-Year VA Cash Out refinance. A VA approved lender can streamline the refinance process to lower your interest rate andor monthly payment.

If youre VA disabled have a purple heart or are a military spouse youre exempt from the VA funding fee - typically 23 percent of the loan amount. The Disadvantages Of VA Home Loans. Monitor refinance rates regularly and use Zillows free refinance calculator to make sure a refinance is worth it for your financial circumstances.

Assuming you qualify - ie that you are an. Here are a few guidelines to keep in mind. However FHA VA and USDA loans have Streamline Refinance options which often dont require a new appraisal.

Our mortgage refinance calculator can help borrowers estimate their new monthly mortgage payments the total costs of refinancing and how long it will take to recoup those costs. Streamline FHA 203k Rehabilitation Loans September 13 2022 - The FHA offers something called a 203k Rehab loan for borrowers who want to purchase and rehab a property. Streamline Refinance Cash-out Refinance Simple Refinance Rehabilitation Loan.

VA lenders often look for a minimum credit score of at least 620 for cash-out refinances. If you currently have one or more VA loans and looking to refinance one of them use this calculator to see if you will need a down payment or if your sufficient equity. The VA cash-out works to refinance any loan type while the IRRRL refinances only VA loans The VA cash-out can borrow against up to 100 of your home equity.

Rates Requirements for 2022 April 14 2022 The Best Mortgage Refinance Companies for 2022 June 9 2022. VA streamline refinance. Unlike the VA Streamline Refinance IRRRL program a VA cash-out refinance allows you to.

VA IRRRL rates and guidelines. Contact our licensed Mortgage Loan Officers today to see how big your monthly savings could be. However some VA lenders impose their own waiting period of up to 12 months.

The FHA Streamline Refinance is Village Capitals expertise. Homeowners can also use the program to refinance their existing mortgage and add the cost of remodeling projects into the new loan. Todays national mortgage rate trends.

The VA requires you to wait 7 months 210 days from your last loan closing before using the VA Streamline Refinance. VA Streamline refinance loans are relatively easy and can be completed quickly due to the fact that homeowners are refinancing from one VA Loan product to another. Veterans receiving compensation for a service-connected disability surviving spouses and select others are exempt from paying the VA Funding Fee.

To get started call 1-800-884-5560 or start your VA Refinance quote online. VA Cash-Out Refinance Requirements. Please note that investor guidelines for the FHA and VA One-Time Close Construction Program only allows for single family dwellings 1 unit and NOT for multi-family units no duplexes triplexes or.

For today Thursday September 15 2022 the current average rate for a 30-year fixed mortgage is 619 increasing 11 basis points compared to this time. Two main programs help VA borrowers refinance to a lower rate -- the VA Streamline Refinance also known as the Interest Rate Reduction Refinance Loan IRRRL and the VA Cash-Out Refinance. VA IRRRLs can save thousands of dollars over the life of the loan and typically do not.

These Refinance loan rates assume a loan-to-value ratio lower than 90. VA interest rate reduction refinance loans IRRRLs are an easy way to refinance your loan to a lower rate and lower your monthly payments with minimal out-of-pocket costs. However those who do have a VA loan already may wish to consider a VA streamline refinance or interest rate reduction refinance loan IRRRL which can help you lower your interest rate or extend your repayment termA VA streamline refinance loan a simplified lending.

True to its name this program also known as the Interest Rate Reduction Refinance Loan IRRRL pronounced earl involves little paperwork. FHA 203k loans come in two types.

Va Loan Calculator Estimate Your Monthly Mortgage Payment And Va Funding Fee The Military Wallet

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Va Streamline Refinance Seattle Bellevue Wa Or Id Co

Fha Streamline Refinance Rates Requirements For 2022

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Va Refinance Calculator The Home Loan Expert

Va Streamline Refinance Va Irrrl How It Works And When To Get One Credible

Va Streamline Refinance A Quick Way To Get A Better Rate Forbes Advisor

Va Loans San Diego

Va Loan Calculator

Va Streamline Refinance Va Irrrl How It Works And When To Get One Credible

How To Use Our Refinance Calculator Signature Home Loans Phoenix Az

Va Loan Funding Fee What You Ll Pay In 2022 Nerdwallet

How To Use Our Refinance Calculator Signature Home Loans Phoenix Az

Va Refinance American Pacific Mortgage

Va Streamline Refinance Guidelines And Requirements

Va Loan Calculator Estimates Your Mortgage Payment Casaplorer